ShareThis

ShareThis  Positive underlying fundamentals continue to support all of the major commercial real estate sectors, but a slowdown in job creation and ongoing tight loan availability has tempered growth in some areas, according to the National Association of Realtors? quarterly commercial real estate forecast.

Positive underlying fundamentals continue to support all of the major commercial real estate sectors, but a slowdown in job creation and ongoing tight loan availability has tempered growth in some areas, according to the National Association of Realtors? quarterly commercial real estate forecast.

Although still positive, dampened demand is slightly moderating rent growth, with one exception: the multifamily market.? ?Sharply higher demand for apartments is causing rents to rise at faster rates,? says Lawrence Yun, NAR Chief Economist.? ?A return to normal household formation will mean even lower vacancy rates and higher rents in the future.?

The current commercial real estate cycle has been driven by shifts in demand without an oversupply of new construction.? ?The difficulty small businesses have in getting commercial real estate loans for leasing or purchase is keeping a lid on demand,? Yun explained.? ?Multifamily is the only commercial sector with a notable growth in new space, with some lending provided through government loans.?

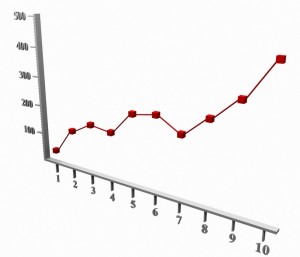

With the exception of multifamily, vacancy rates remain above historic averages seen since 1999. Over that timeframe the typical vacancy rate has been 14.4 percent for the office market, 10.1 percent in industrial, 8.1 percent for retail and 5.8 percent in multifamily.

Vacancy rates are marginally declining and rents are modestly rising in all of the sectors, but significant changes in the outlook are unlikely before the end of the year. Many corporate decisions on spending and job hiring are on hold given uncertainty over the upcoming elections, whether Congress will effectively avoid a ?fiscal cliff,? and unsettled issues such as health care and banking/financial regulations.

?Overall companies hold plentiful cash reserves, but they are hesitant to hire without clarity over how these outstanding issues will impact the bottom line,? Yun said.

?Commercial real estate gains could be thwarted if lending from small and community banks dry up from excessive regulatory compliance costs, and if international big-bank capital rules are applied to smaller lending institutions,? Yun added.

The apartment rental market is expected to see vacancy rates drop from 4.3 percent in the third quarter to 4.2 percent in the third quarter of 2013; vacancy rates below 5 percent generally are considered a landlord?s market with demand justifying higher rents.

Areas with the lowest multifamily vacancy rates currently are Portland, Ore., at 2.0 percent; New York City and Minneapolis, both at 2.2 percent; and New Haven, Conn., and San Jose, Calif., both at 2.4 percent.

Average apartment rent is likely to increase 4.1 percent in 2012 and another 4.4 percent next year.? Multifamily net absorption should be 219,300 units this year and 236,600 in 2013.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

ShareThis

ShareThis birth control recall nick carter leslie carter aaron carter sister pfizer signing day 2012 football gasland

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন